Introduction

Welcome to the CGG Services Healthcare Scheme guide.

CGG have appointed us, Healix Health Services Ltd, to manage this scheme. Our role is to assess and manage medical needs that you might have as well as the care and treatment you receive.

The CGG Services Healthcare Scheme is designed to cover you for the diagnosis and/or treatment of a short term medical condition, if the treatment is medically necessary.

The scheme is not intended to cover all medical conditions. There are some medical conditions and treatments that are excluded from cover (please see exclusions and limitations for further details on this).

All treatment (including consultations and diagnostic tests) should be authorised in advance. Therefore it is essential that you call us before you receive treatment, to ensure that your proposed treatment is eligible for cover under the scheme.

Table of benefits - CORE

Your scheme benefits are set out in the table below.

Benefit limits apply to each individual member or dependant in any one year of cover, unless otherwise stated.

All claims are subject to your excess, which will be applied to the first eligible treatment within each scheme year.

Please note the below benefits are subject to an overall benefit limit of £80,000 per member per scheme year.

The scheme will commence on the 1st January 2024 to 31st December 2024.

| Outpatient Diagnostics | Level of cover | Benefit note |

Outpatient consultations with a specialist following GP referral Outpatient diagnostic tests and investigations following GP or specialist referral Outpatient treatment following specialist referral Outpatient consultations with a practitioner Outpatient consultations and diagnostic tests with a specialist on self-referral for breast, bowel, prostate and testicular cancer symptoms |

Full cover | 1a |

Neurodevelopmental assessment |

Up to £2,000 per scheme lifetime | 1b |

| Outpatient Treatment | ||

Orthotics |

Up to £500 per scheme lifetime | 2a |

Outpatient MRI, CT and PET scans on specialist referral |

Full cover | 2b |

Outpatient surgical procedures |

Full cover | 2c |

| Outpatient Therapies | ||

In-network physiotherapy (including self-referral) |

Full cover | 3a |

Out of network physiotherapy following GP or specialist referral |

Full cover | 3b |

Outpatient complementary therapies following GP or specialist referral |

Full cover (limited to £250 per scheme year on GP referral) | 3c |

| Inpatient and Daycase Treatment | ||

Specialist fees for inpatient and daycase treatment |

Full cover within reasonable and customary guidelines | 4a |

Hospital charges for inpatient or daycase treatment |

Full cover | 4b |

Parent accommodation |

Full cover | 4c |

| Cancer Treatment | ||

Cancer treatment |

Full cover | 5a |

Cancer outpatient complementary therapies |

Combined limit of up to £2,000 per condition | 5b |

Cancer outpatient mental health treatment |

Up to £1,000 per scheme year | 5c |

Cancer additional services |

Full cover | 5d |

| Cash Benefits | ||

NHS cash benefit |

£200 each day or night | 6a |

NHS cash alternative |

Up to 25% of the costs to receive the procedure privately – please contact us to check if your procedure will be eligible | 6b |

NHS cancer cash benefit |

£300 each day or night | 6c |

NHS cancer cash benefit for oral chemotherapy and targeted therapies |

£600 per month | 6d |

COVID-19 NHS cash benefit |

£300 per day or night up to 30 days per scheme year | 6e |

| Benefits for Specified Treatment | ||

Rehabilitation |

Limited cover | 7a |

Oral surgical procedures |

Full cover for specified treatments | 7b |

Disorders of the eye |

Full cover for specified treatments | 7c |

Pregnancy and childbirth |

Full cover for specified treatments | 7d |

Fertility treatment |

Up to £10,000 per member per scheme lifetime | 7e |

Fertility investigations |

Full cover | 7f |

Women's and Men's Health Benefit Remote advice service with our in-network specialist gynaecologists or men's health specialist (up to 4 consultations per scheme year) Diagnostic tests and investigations following referral from our in-network remote gynaecologists or men's health specialist (up to £500 per scheme year) |

Limited cover | 7g |

Long COVID Benefit Outpatient consultations and diagnostics required as a result of Long COVID Outpatient, daycase and inpatient treatment required as a result of Long COVID Outpatient mental health treatment required as a result of Long COVID (up to £1,500 per scheme year) Outpatient physiotherapy treatment required as a result of Long COVID (up to £500 per scheme year) Outpatient complementary therapies required as a result of Long COVID (up to £250 per scheme year) |

Combined overall limit of £5,000 per scheme year (up to £15,000 per scheme lifetime) | 7h |

Mental heath treatment |

Up to a maximum of £20,000 per scheme year | 7i |

| Additional Benefits | ||

Private ambulance charges |

Full cover | 8 |

Home healthcare |

Full cover | 9 |

Virtual GP |

Unlimited | 10 |

Overseas emergency treatment |

Limited cover | 11 |

Note: The above benefits only apply when the covered person has treatment in the UK, or when temporarily abroad on holiday or business up to specified limits.

Outpatient investigations and treatment

We will pay in full for:

- outpatient consultations with a specialist following GP referral

- outpatient diagnostics and investigations following GP or specialist referral

- outpatient treatment following specialist referral

Cover is subject to our reasonable and customary fees.

Outpatient consultations with a practitioner

We will pay in full for consultations with a dietician, nurse, orthoptist, podiatrist or speech therapist following GP or specialist referral. The practitioner must be registered with the correct governing body for their field, and meet our definition for a practitioner.

Outpatient consultations with a specialist on self-referral for breast, bowel, prostate or testicular cancer symptoms

We will pay in full for self-referred* consultations and investigations for breast, bowel, prostate or testicular cancer symptoms.

Please refer to the self-referred cancer benefits page for further information on how to access this benefit.

If a diagnosis of cancer is made, cover for eligible treatment will be subject to any limits as detailed in your cancer treatment benefit.

*Please note, cover for self-referral is subject to the medical underwriting on your scheme

Back to topWe will pay up to £2,000 per member per scheme lifetime for the assessment of neurodevelopmental disorders following GP or specialist referral. Assessment must be carried out by a specialist or educational psychologist that we recognise for benefit purposes.

You must have our confirmation before any assessment is carried out and we need full clinical details from your GP or specialist before we can confirm cover.

Once a diagnosis has been confirmed, there will be no further cover for any additional investigations, assessments or treatment in the future.

Please note this benefit is not subject to your scheme underwriting.

Back to topWe will pay up to £500 per scheme lifetime towards medically necessary orthotics, when these are recommended by a practitioner, physiotherapist, specialist or GP.

Back to topWe will pay in full for MRI, CT and PET scans on specialist referral.

Back to topWe will pay in full for hospital charges and specialist fees for outpatient surgical procedures, and drugs and dressings used during an outpatient appointment.

Cover is subject to our reasonable and customary fees.

Back to topWe will pay in full for outpatient physiotherapy following GP, specialist or self-referral when treatment is provided by our physiotherapy network provider

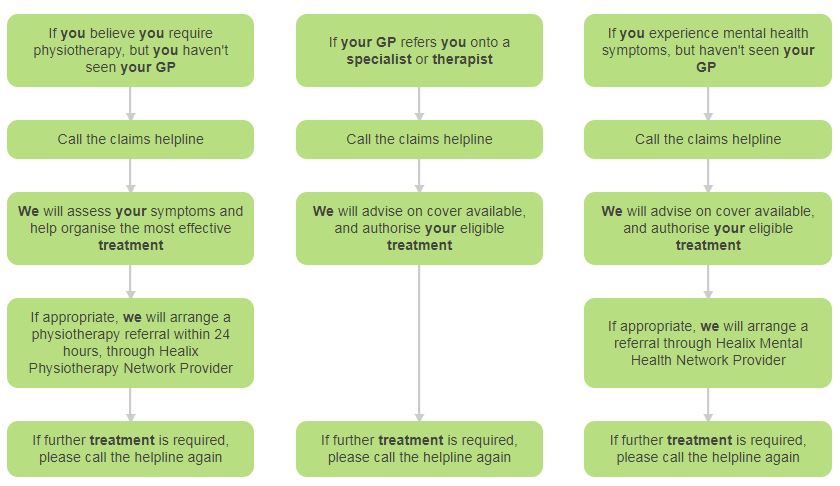

Please refer to the musculoskeletal pathway for further information.

Back to topWe will pay in full for out of network outpatient physiotherapy following GP or specialist referral.

The physiotherapist must still be recognised by us for benefit purposes.

Back to topWe will pay in full for chiropractic treatment, osteopathy and acupuncture, following GP or specialist referral. You must be referred to a complementary practitioner we have recognised for benefit purposes.

Please note cover is limited to £250 per scheme year if referred by your GP.

Back to topWe will pay for specialist fees for inpatient and daycase treatment. Cover is subject to our reasonable and customary fees.

Back to topWe will pay hospital charges in full for the following:

- accommodation and nursing care for inpatient or daycase treatment

- operating theatre and recovery room

- prescribed medicines and dressings, for use whilst an inpatient or for daycase treatment

- eligible surgical appliances - for example, a knee brace following ligament surgery

- prosthesis or device which is inserted during eligible surgery

- pathology, radiology, diagnostic tests, MRI, CT and PET scans

- physiotherapy received during inpatient or daycase treatment

- intensive care

- short-term dialysis when needed temporarily for sudden kidney failure resulting from an eligible condition or treatment

- skin and corneal grafts

We will pay reasonable hospital costs for one parent or legal guardian to stay with a child who is under 16 years old, if a child is admitted to hospital as an inpatient. Cover for this benefit will stop on the child’s 16th birthday. If your child is an inpatient on their 16th birthday, then cover will extend until they are discharged on that occasion. We will only pay the cost if:

- it is the parent or legal guardian who stays with the child

- the treatment the child receives is covered by the scheme

We will pay for cancer treatment as detailed in the cancer cover explained table.

Please refer to your cancer support explained for information on the additional supportive services available to employees.

Back to topWe will pay up to £2,000 combined per condition for acupuncture, osteopathy and chiropractic treatment, when recommended by your specialist and required as a direct result of eligible cancer treatment. Treatment must be taken with a complementary practitioner we recognise for benefit purposes. Complementary or alternative products, preparations or remedies are not covered by the scheme.

Back to topWe will pay up to £1,000 per scheme year on GP, specialist or self-referral for outpatient mental health treatment required as a direct result of eligible cancer treatment.

Mental health treatment is only covered if it is provided by a psychological therapist or psychiatrist.

Back to topWe will pay in full for the cost of external prosthesis, wigs, scalp cooling treatment and medical tattooing for reconstructive purposes only when recommended by your specialist and required as a direct result of eligible cancer treatment.

For wigs and medical tattooing, this benefit is available on a pay and claim basis only.

Back to topIn the event that you are admitted to an NHS hospital, or you elect to receive free treatment through the NHS we will pay an NHS cash benefit of £200 per day or night, for inpatient or daycase treatment. This benefit will only apply to claims for daycase or inpatient treatment that would otherwise have been eligible for benefit under your scheme.

The benefit would be paid to you on completion of your treatment and receipt of the necessary documents, which must be submitted within six months of your treatment date. If you require further information on how to access this benefit, please call on 0208 481 7823.

Back to topIn the event that you require an eligible elective surgical procedure, and you choose to receive this treatment free of charge on the NHS, we may pay you a cash lump sum. Please contact us to check if your procedure will qualify for this benefit.

Back to topIn the event that you elect to receive free cancer treatment through the NHS, we will pay an NHS cancer cash benefit of £300 per night or day following eligible inpatient or daycase treatment, or outpatient radiotherapy treatment.

This benefit will only apply to claims for daycase or inpatient treatment that would otherwise have been eligible for benefit under your scheme.

Back to topIn the event that you elect to receive oral chemotherapy or targeted therapies via the NHS as an outpatient, we will pay an NHS cancer cash benefit of £600 per month whilst you receive such treatment.

Back to topIn the event that you are admitted to hospital and receive free NHS funded treatment we will pay an NHS cash benefit of £300 per day or night for a maximum of 30 days following inpatient or daycase treatment. This benefit will only apply to claims for daycase or inpatient treatment of COVID-19 and/or complications arising from this condition.

Back to topWe will pay up to 28 days of inpatient, daycase and/or outpatient rehabilitation treatment which is intended to restore health or mobility with the aim of returning you to independent living. The rehabilitation must be referred by a specialist and be an integral part of eligible treatment. Treatment must take place within 12 months of you having been deemed medically fit to commence rehabilitation by your specialist.

Back to topWe will pay for the following specified oral surgical operations carried out by a specialist:

-

surgically remove a complicated, buried, infected or impacted tooth root

-

apicectomy or removal of the tip of a tooth’s root

-

enucleation of a cyst of the jaw (removing a cyst from the jaw bone)

-

surgical drainage of a fascial space (tracking) abscess

-

putting a natural tooth back into a jaw bone after it is knocked out or dislodged in an accident

-

treatment of facial and mandibular fractures

We will pay for eligible acute treatment of the following conditions:

-

cataracts

-

detached retina

-

surgical correction of a squint

-

drooping Eyelids (ptosis) – We will only provide benefit for ptosis (drooping eyelids), if your optometrist identifies visual impairment and you are referred by your general practitioner or optician to a consultant ophthalmologist

-

wet aged related macular degeneration, where we will pay for a short course of treatment following initial diagnosis

We will pay for the following specified obstetric procedures / treatment:

-

pelvic girdle pain in pregnancy

-

miscarriage or when the foetus has died and remains with the placenta in the womb

-

still birth

-

hydatidiform mole (abnormal cell growth in the womb)

-

ectopic pregnancy (foetus growing outside the womb)

-

Diastasis recti or Rectus Abdominis (splitting of the abdominal muscles during pregnancy)

-

post-partum haemorrhage (heavy bleeding in the hours and days immediately after childbirth)

-

retained placental membrane (afterbirth left in the womb after the delivery of the baby)

-

eligible mental health treatment for post-natal depression subject to the conditions and limitations set out in the mental health benefit.

-

medically essential caesarean section where this is an inevitable consequence of a complication to the current pregnancy.

-

complications following any of the above conditions.

-

flare up of a non-pregnancy related medical condition that has been made worse by pregnancy

We will require full clinical details from your specialist before we can give our decision on cover.

In the event that the newborn requires immediate treatment as a result of an eligible caesarean section, this should be administered by the NHS free of charge. If the newborn is not entitled to NHS care and is not accepted as a dependant on the scheme we will pay for treatment for up to 7 days following the birth, to allow you time to make alternative arrangements. In cases where they are accepted as a member of the scheme they will only be entitled to benefits outlined in the benefits table and will be subject to the exclusions listed within the scheme.

Back to topWe will pay up to £10,000 per scheme lifetime for fertility treatment as detailed in the fertility treatment explained page.

Back to topWe will pay in full for medically necessary fertility investigations following GP or specialist referral.

Back to topRemote advice service with our in-network specialist gynaecologists or men's health specialists

We will pay for up to 4 remote advice appointments per scheme year with our in-network specialist gynaecologists or men’s health specialists on self-referral. This service can be used to discuss any health concern including conditions that are normally excluded for cover such as the menopause, andropause, sexual health concerns, fertility or contraception advice.

Diagnostic tests and investigations following referral from our in-network gynaecologists or men's health specialists

We will pay up to £500 per scheme year for diagnostic tests or investigations that are recommended following a remote advice appointment with our in-network specialist gynaecologists or men’s health specialists.

Remote consultations and diagnostic tests and investigations will be covered up to the limits described above only. Once the benefit limits have been reached the scheme rules will apply as detailed in your exclusions and limitations.

Please note: additional cover may be available outside of the above limits for eligible claims, please contact the claims helpline for further information.

Please refer to the women's or men's health services page for further information on how to access these benefits.

Back to topThe below benefits will be paid for when treatment is required as a result of COVID-19 (commonly referred to as 'long COVID'). The benefits have a combined limit of £5,000 per scheme year up to a maximum of £15,000 per scheme lifetime.

Outpatient consultations and diagnostics

We will pay up in full for:

- Outpatient consultations with a specialist following GP referral

- Outpatient diagnostics and investigations following GP or specialist referral

- Outpatient treatment following specialist referral

Cover is subject to our reasonable and customary fees.

Outpatient, daycase and inpatient treatment

We will pay for hospital and specialist fees, for outpatient, daycase and inpatient treatment. Please note cover is not available for acute treatment of COVID-19, including treatment in an intensive care unit, high dependency unit, acute ward setting or NHS hospital.

Outpatient mental health treatment

We will pay up to £1,500 per scheme year, for outpatient consultations for eligible mental health conditions, following GP or self-referral*, when treatment is required as a result of long COVID.

If your referral is to a psychological therapist we will arrange a telephone based clinical assessment with a senior psychological therapist from our mental health network provider, who will help organise the most effective treatment for you. This could include face to face therapy, guided self-management or specialist referral. Where treatment with a psychological therapist occurs outside our network provider, it must be delivered under the direct supervision of a consultant psychiatrist.

*Please note, cover for self-referral is subject to the medical underwriting on your scheme.

Outpatient physiotherapy

We will pay up to £500 per scheme year for outpatient physiotherapy following GP or self-referral*, when treatment is required as a result of long COVID.

If this is a self-referral, we will arrange a telephone based clinical assessment with a senior physiotherapist, who will help organise the most effective treatment for you. This could include face to face physiotherapy, guided self-management or specialist referral. The telephone based clinical assessment will not be subject to any excess, if one applies, however it will be applied to subsequent treatment should this be required. We will continue to monitor your progress by liaising with your treatment provider and authorise additional treatment where necessary and eligible.

If treatment takes place outside our physiotherapy network, the physiotherapist must still be recognised by us for benefit purposes.

*Please note, cover for self-referral is subject to the medical underwriting on your scheme.

Outpatient complementary therapies

We will pay up to £250 per scheme year for chiropractic treatment, osteopathy and acupuncture, following GP or specialist referral, when treatment is required as a result of long COVID. You must be referred to a complementary practitioner we have recognised for benefit purpose.

Back to topWe will pay a combined limit of £20,000 per scheme year for medical necessary outpatient, daycase or inpatient treatment, in an NHS or private psychiatric unit, for mental health conditions, which we agree are eligible in writing and in advance.

Outpatient treatment

We will pay for outpatient consultations for eligible mental health conditions following GP or self-referral*.

Where treatment with a psychological therapist occurs outside our network provider it must be delivered under the direct supervision of a consultant psychiatrist.

Please refer to the mental health pathway for further information.

*Please note, cover for self-referral is subject to the medical underwriting on your scheme and under 18’s will require a referral letter from their own GP.

Inpatient and daycase treatment

We will pay for eligible inpatient and daycase mental health treatment. All treatment must be under the direct control and supervision of a consultant psychiatrist, and must be authorised by us in advance and in writing.

Back to topWe will pay in full for transport by a private ambulance to and/or from a hospital when ordered for medical reasons.

Back to topWe will pay in full for home nursing charges for registered nurses when recommended by a specialist and where treatment is:

-

medically necessary and without it you would have to receive treatment as an inpatient or daycase admission

-

needed for medical reasons (i.e. not social or domestic reasons)

-

under the direct supervision of a specialist

Mental health treatment delivered at home or in the community is not covered by the scheme.

Back to topPlease refer to the virtual GP page for further information on how to access this benefit.

Back to topThe scheme is designed to cover treatment in the UK, and therefore provides limited cover for treatment you may require whilst abroad. We strongly recommend that you ensure you have adequate travel insurance and/or a European Health Insurance Card / Global Health Insurance Card in place before you travel abroad on holiday.

If you wish to claim for emergency treatment received abroad, you must send us proof of how long you were abroad for (this period should not exceed 28 consecutive days). You should also send us all medical bills and receipts associated with your treatment. Failure to submit receipts within six months of the date of treatment may result in the claim being denied.

We will reimburse reasonable and customary costs for overseas emergency treatment as detailed below:

|

Treatment: |

Reimbursement level: |

|

Specialist fees |

Within our reasonable and customary fees |

|

MRI, CT and PET scans |

Up to £100 per trip |

|

Outpatient surgical procedures |

Up to £100 per trip |

|

Other emergency outpatient treatment (excluding MRI, CT and PET scans, and outpatient surgical procedures) |

Up to annual outpatient benefit limits, as detailed in the table of benefits |

|

Inpatient or daycase surgical procedures |

Up to £200 per trip |

We will only pay up to the above limits if the following apply:

-

the treatment is eligible for benefit

-

the treatment is carried out by a specialist who is:

-

fully trained and legally qualified and permitted to practice by the relevant authorities in the country in which your treatment takes place, and

-

is recognised by the relevant authorities in that country as having specialised knowledge of, or expertise in, treatment of the disease, illness or injury being treated; and

-

the treatment facility is specifically recognised or registered under the laws of the territory in which it stands for providing the treatment delivered.

We will not pay for overseas emergency treatment in any country if:

-

the Foreign and Commonwealth Office has advised against travel to that country or area. If you are already in the country or area when the Foreign and Commonwealth Office advises against travel, and you require treatment, this should be claimed for under your travel insurance policy

-

you are already in that particular country or area and have been advised to leave unless prior written authority has been received from us. If you are unable to leave a particular country or area after being advised to do so, and you require treatment, this should be claimed for under your travel insurance policy

-

you travelled abroad despite being given medical advice not to travel abroad

-

you travelled abroad to receive treatment, or

-

the treatment you require is related to a pre-existing condition.

The scheme will not pay for:

-

GP services or fees

-

outpatient prescriptions

-

take home drugs and dressings

-

any costs associated with an evacuation or repatriation

-

any treatment that should be free or provided at a reduced cost under a reciprocal agreement or EHIC/GHIC.

Costs of private treatment in facilities in the European Union, Iceland, Liechtenstein, Norway or Switzerland or costs in state facilities in these countries which should have been free or reduced if you had had a European Health Insurance Card / Global Health Insurance Card are not covered under the scheme.

If you are a UK resident, you are entitled to medical treatment that becomes necessary, at reduced cost or sometimes free, when temporarily visiting a European Union (EU) country, Iceland, Liechtenstein, Norway or Switzerland. Only treatment provided under the state scheme (the country’s equivalent to the NHS) is covered. However, to obtain treatment you will need to take a European Health Insurance Card (EHIC) or Global Health Insurance Card (GHIC) with you.

EHIC are still valid if in date, but they have now been replaced by the GHIC. You can apply for a GHIC by clicking here.

Your scheme will not cover you for the costs of an evacuation or repatriation should you require this. Therefore we strongly recommend that you take out appropriate travel insurance if you are going abroad to ensure that you have adequate cover for any healthcare needs you have along with cover for loss of luggage etc.

Back to top

Table of benefits - BOOST

Your scheme benefits are set out in the table below.

Benefit limits apply to each individual member or dependant in any one year of cover, unless otherwise stated.

The scheme will commence on the 1st January 2024 to 31st December 2024.

| Outpatient Diagnostics | Level of cover | Benefit note |

Outpatient consultations with a specialist following GP referral Outpatient diagnostic tests and investigations following GP or specialist referral Outpatient treatment following specialist referral Outpatient consultations with a practitioner Outpatient consultations and diagnostic tests with a specialist on self-referral for breast, bowel, prostate or testicular cancer symptoms |

Full cover | A1 |

Neurodevelopmental assessment |

Up to £2,000 per scheme lifetime | A2 |

| Outpatient Treatment | ||

Orthotics |

Up to £500 per scheme lifetime | B1 |

Outpatient MRI, CT and PET scans on specialist referral |

Full cover | B2 |

Outpatient surgical procedures |

Full cover | B3 |

| Outpatient Therapies | ||

In-network physiotherapy (including self-referral) |

Full cover | C1 |

Out of network physiotherapy following GP or specialist referral |

Full cover | C2 |

Outpatient complementary therapies following GP, specialist or self-referral |

Full cover | C3 |

| Inpatient and Daycase Treatment | ||

Specialist fees for inpatient and daycase treatment |

Full cover within reasonable and customary guidelines | D1 |

Hospital charges for inpatient or daycase treatment |

Full cover | D2 |

Parent accommodation |

Full cover | D3 |

| Cancer Treatment | ||

Cancer treatment |

Up to £100,000 per scheme year | E1 |

Cancer outpatient complementary therapies |

Combined limit of up to £2,000 per condition | E2 |

Cancer outpatient mental health treatment |

Up to £1,000 per scheme year | E3 |

Cancer additional services |

Full cover | E4 |

| Cash Benefits | ||

NHS cash benefit |

£300 each day or night | F1 |

NHS cash alternative |

Up to 25% of the costs to receive the procedure privately – please contact us to check if your procedure will be eligible | F2 |

NHS cancer cash benefit |

£300 each day or night | F3 |

NHS cancer cash benefit for oral chemotherapy and targeted therapies |

£600 per month | F4 |

COVID-19 NHS cash benefit |

£300 per day or night up to 30 days per scheme year | F5 |

| Benefits for Specified Treatment | ||

Rehabilitation |

Limited cover | G1 |

Oral surgical procedures |

Full cover for specified treatments | G2 |

Disorders of the eye |

Full cover for specified treatments | G3 |

Pregnancy and childbirth |

Full cover for specified treatments | G4 |

Fertility treatment |

Up to £10,000 per member per scheme lifetime | G5 |

Fertility investigations |

Full cover | G6 |

Chronic conditions |

Up to £1,000 per scheme year | G7 |

Women's and Men's Health Benefit Remote advice service with our in-network specialist gynaecologists or men's health specialist (up to 4 consultations per scheme year) Diagnostic tests and investigations following referral from our in-network remote gynaecologists or men's health specialist (up to £500 per scheme year) |

Limited cover | G8 |

Long COVID Benefit Outpatient consultations and diagnostics required as a result of Long COVID Outpatient, daycase and inpatient treatment required as a result of Long COVID Outpatient mental health treatment required as a result of Long COVID (up to £1,500 per scheme year) Outpatient physiotherapy treatment required as a result of Long COVID (up to £500 per scheme year) Outpatient complementary therapies required as a result of Long COVID (up to £250 per scheme year) |

Combined overall limit of £5,000 per scheme year (up to £15,000 per scheme lifetime) | G9 |

Mental heath treatment |

Up to a maximum of £20,000 per scheme year | G10 |

| Additional Benefits | ||

Private ambulance charges |

Full cover | H |

Home healthcare |

Full cover | I |

Virtual GP |

Unlimited | J |

Overseas emergency treatment |

Limited cover | K |

Note: The above benefits only apply when the covered person has treatment in the UK, or when temporarily abroad on holiday or business up to specified limits.

Outpatient investigations and treatment

We will pay in full for:

- outpatient consultations with a specialist following GP referral

- outpatient diagnostics and investigations following GP or specialist referral

- outpatient treatment following specialist referral

Cover is subject to our reasonable and customary fees.

Outpatient consultations with a practitioner

We will pay in full for consultations with a dietician, nurse, orthoptist, podiatrist or speech therapist following GP or specialist referral. The practitioner must be registered with the correct governing body for their field, and meet our definition for a practitioner.

Outpatient consultations with a specialist on self-referral for breast, bowel, prostate or testicular cancer symptoms

We will pay in full for self-referred* consultations and investigations for breast, bowel, prostate or testicular cancer symptoms.

Please refer to the self-referred cancer benefits page for further information on how to access this benefit.

If a diagnosis of cancer is made, cover for eligible treatment will be subject to any limits as detailed in your cancer treatment benefit.

*Please note, cover for self-referral is subject to the medical underwriting on your scheme

Back to topWe will pay up to £2,000 per member per scheme lifetime for the assessment of neurodevelopmental disorders following GP or specialist referral. Assessment must be carried out by a specialist or educational psychologist that we recognise for benefit purposes.

You must have our confirmation before any assessment is carried out and we need full clinical details from your GP or specialist before we can confirm cover.

Once a diagnosis has been confirmed, there will be no further cover for any additional investigations, assessments or treatment in the future.

Please note this benefit is not subject to your scheme underwriting.

Back to topWe will pay up to £500 per scheme lifetime towards medically necessary orthotics, when these are recommended by a practitioner, physiotherapist, specialist or GP.

Back to topWe will pay in full for MRI, CT and PET scans on specialist referral.

Back to topWe will pay in full for hospital charges and specialist fees for outpatient surgical procedures, and drugs and dressings used during an outpatient appointment.

Cover is subject to our reasonable and customary fees.

Back to topWe will pay in full for outpatient physiotherapy following GP, specialist or self-referral when treatment is provided by our physiotherapy network provider

Please refer to the musculoskeletal pathway for further information.

Back to topWe will pay in full for out of network outpatient physiotherapy following GP or specialist referral.

The physiotherapist must still be recognised by us for benefit purposes.

Back to topWe will pay in full for chiropractic treatment, osteopathy and acupuncture, following GP, specialist or self-referral. You must be referred to a complementary practitioner we have recognised for benefit purposes.

Back to topWe will pay for specialist fees for inpatient and daycase treatment. Cover is subject to our reasonable and customary fees.

Back to topWe will pay hospital charges in full for the following:

- accommodation and nursing care for inpatient or daycase treatment

- operating theatre and recovery room

- prescribed medicines and dressings, for use whilst an inpatient or for daycase treatment

- eligible surgical appliances - for example, a knee brace following ligament surgery

- prosthesis or device which is inserted during eligible surgery

- pathology, radiology, diagnostic tests, MRI, CT and PET scans

- physiotherapy received during inpatient or daycase treatment

- intensive care

- short-term dialysis when needed temporarily for sudden kidney failure resulting from an eligible condition or treatment

- skin and corneal grafts

We will pay reasonable hospital costs for one parent or legal guardian to stay with a child who is under 16 years old, if a child is admitted to hospital as an inpatient. Cover for this benefit will stop on the child’s 16th birthday. If your child is an inpatient on their 16th birthday, then cover will extend until they are discharged on that occasion. We will only pay the cost if:

- it is the parent or legal guardian who stays with the child

- the treatment the child receives is covered by the scheme

We will pay for cancer treatment as detailed in the cancer cover explained table.

Please refer to your cancer support explained for information on the additional supportive services available to employees.

Back to topWe will pay up to £2,000 combined per condition for acupuncture, osteopathy and chiropractic treatment, when recommended by your specialist and required as a direct result of eligible cancer treatment. Treatment must be taken with a complementary practitioner we recognise for benefit purposes. Complementary or alternative products, preparations or remedies are not covered by the scheme.

Back to topWe will pay up to £1,000 per scheme year on GP, specialist or self-referral for outpatient mental health treatment required as a direct result of eligible cancer treatment.

Mental health treatment is only covered if it is provided by a psychological therapist or psychiatrist.

Back to topWe will pay in full for the cost of external prosthesis, wigs, scalp cooling treatment and medical tattooing for reconstructive purposes only when recommended by your specialist and required as a direct result of eligible cancer treatment.

For wigs and medical tattooing, this benefit is available on a pay and claim basis only.

Back to topIn the event that you are admitted to an NHS hospital, or you elect to receive free treatment through the NHS we will pay an NHS cash benefit of £300 per day or night, for inpatient or daycase treatment. This benefit will only apply to claims for daycase or inpatient treatment that would otherwise have been eligible for benefit under your scheme.

The benefit would be paid to you on completion of your treatment and receipt of the necessary documents, which must be submitted within six months of your treatment date. If you require further information on how to access this benefit, please contact the claims helpline.

Back to topIn the event that you require an eligible elective surgical procedure, and you choose to receive this treatment free of charge on the NHS, we may pay you a cash lump sum. Please contact us to check if your procedure will qualify for this benefit.

Back to topIn the event that you elect to receive free cancer treatment through the NHS, we will pay an NHS cancer cash benefit of £300 per night or day following eligible inpatient or daycase treatment, or outpatient radiotherapy treatment.

This benefit will only apply to claims for daycase or inpatient treatment that would otherwise have been eligible for benefit under your scheme.

Back to topIn the event that you elect to receive oral chemotherapy or targeted therapies via the NHS as an outpatient, we will pay an NHS cancer cash benefit of £600 per month whilst you receive such treatment.

Back to topIn the event that you are admitted to hospital and receive free NHS funded treatment we will pay an NHS cash benefit of £300 per day or night for a maximum of 30 days following inpatient or daycase treatment. This benefit will only apply to claims for daycase or inpatient treatment of COVID-19 and/or complications arising from this condition.

Back to topWe will pay up to 28 days of inpatient, daycase and/or outpatient rehabilitation treatment which is intended to restore health or mobility with the aim of returning you to independent living. The rehabilitation must be referred by a specialist and be an integral part of eligible treatment. Treatment must take place within 12 months of you having been deemed medically fit to commence rehabilitation by your specialist.

Back to topWe will pay for the following specified oral surgical operations carried out by a specialist:

-

surgically remove a complicated, buried, infected or impacted tooth root

-

apicectomy or removal of the tip of a tooth’s root

-

enucleation of a cyst of the jaw (removing a cyst from the jaw bone)

-

surgical drainage of a fascial space (tracking) abscess

-

putting a natural tooth back into a jaw bone after it is knocked out or dislodged in an accident

-

treatment of facial and mandibular fractures

We will pay for eligible acute treatment of the following conditions:

-

cataracts

-

detached retina

-

surgical correction of a squint

-

drooping Eyelids (ptosis) – We will only provide benefit for ptosis (drooping eyelids), if your optometrist identifies visual impairment and you are referred by your general practitioner or optician to a consultant ophthalmologist

-

wet aged related macular degeneration, where we will pay for a short course of treatment following initial diagnosis

We will pay for the following specified obstetric procedures / treatment:

-

pelvic girdle pain in pregnancy

-

miscarriage or when the foetus has died and remains with the placenta in the womb

-

still birth

-

hydatidiform mole (abnormal cell growth in the womb)

-

ectopic pregnancy (foetus growing outside the womb)

-

Diastasis recti or Rectus Abdominis (splitting of the abdominal muscles during pregnancy)

-

post-partum haemorrhage (heavy bleeding in the hours and days immediately after childbirth)

-

retained placental membrane (afterbirth left in the womb after the delivery of the baby)

-

eligible mental health treatment for post-natal depression subject to the conditions and limitations set out in the mental health benefit.

-

medically essential caesarean section where this is an inevitable consequence of a complication to the current pregnancy.

-

complications following any of the above conditions.

-

flare up of a non-pregnancy related medical condition that has been made worse by pregnancy

We will require full clinical details from your specialist before we can give our decision on cover.

In the event that the newborn requires immediate treatment as a result of an eligible caesarean section, this should be administered by the NHS free of charge. If the newborn is not entitled to NHS care and is not accepted as a dependant on the scheme we will pay for treatment for up to 7 days following the birth, to allow you time to make alternative arrangements. In cases where they are accepted as a member of the scheme they will only be entitled to benefits outlined in the benefits table and will be subject to the exclusions listed within the scheme.

Back to topWe will pay up to £10,000 per scheme lifetime for fertility treatment as detailed in the fertility treatment explained page.

Back to topWe will pay in full for medically necessary fertility investigations following GP or specialist referral.

Back to topWe will pay up to £1,000 per scheme year for outpatient consultations with a specialist following GP referral, outpatient diagnostics, treatment and investigations (including therapies) for a chronic condition. Once this benefit limit has been reached the chronic condition rule applies as detailed in your exclusions and limitations.

Back to topRemote advice service with our in-network specialist gynaecologists or men's health specialists

We will pay for up to 4 remote advice appointments per scheme year with our in-network specialist gynaecologists or men’s health specialists on self-referral. This service can be used to discuss any health concern including conditions that are normally excluded for cover such as the menopause, andropause, sexual health concerns, fertility or contraception advice.

Diagnostic tests and investigations following referral from our in-network gynaecologists or men's health specialists

We will pay up to £500 per scheme year for diagnostic tests or investigations that are recommended following a remote advice appointment with our in-network specialist gynaecologists or men’s health specialists.

Remote consultations and diagnostic tests and investigations will be covered up to the limits described above only. Once the benefit limits have been reached the scheme rules will apply as detailed in your exclusions and limitations.

Please note: additional cover may be available outside of the above limits for eligible claims, please contact the claims helpline for further information.

Please refer to the women's or men's health services page for further information on how to access these benefits.

Back to topThe below benefits will be paid for when treatment is required as a result of COVID-19 (commonly referred to as 'long COVID'). The benefits have a combined limit of £5,000 per scheme year up to a maximum of £15,000 per scheme lifetime.

Outpatient consultations and diagnostics

We will pay up in full for:

- Outpatient consultations with a specialist following GP referral

- Outpatient diagnostics and investigations following GP or specialist referral

- Outpatient treatment following specialist referral

Cover is subject to our reasonable and customary fees.

Outpatient, daycase and inpatient treatment

We will pay for hospital and specialist fees, for outpatient, daycase and inpatient treatment. Please note cover is not available for acute treatment of COVID-19, including treatment in an intensive care unit, high dependency unit, acute ward setting or NHS hospital.

Outpatient mental health treatment

We will pay up to £1,500 per scheme year, for outpatient consultations for eligible mental health conditions, following GP or self-referral*, when treatment is required as a result of long COVID.

If your referral is to a psychological therapist we will arrange a telephone based clinical assessment with a senior psychological therapist from our mental health network provider, who will help organise the most effective treatment for you. This could include face to face therapy, guided self-management or specialist referral. Where treatment with a psychological therapist occurs outside our network provider, it must be delivered under the direct supervision of a consultant psychiatrist.

*Please note, cover for self-referral is subject to the medical underwriting on your scheme.

Outpatient physiotherapy

We will pay up to £500 per scheme year for outpatient physiotherapy following GP or self-referral*, when treatment is required as a result of long COVID.

If this is a self-referral, we will arrange a telephone based clinical assessment with a senior physiotherapist, who will help organise the most effective treatment for you. This could include face to face physiotherapy, guided self-management or specialist referral. The telephone based clinical assessment will not be subject to any excess, if one applies, however it will be applied to subsequent treatment should this be required. We will continue to monitor your progress by liaising with your treatment provider and authorise additional treatment where necessary and eligible.

If treatment takes place outside our physiotherapy network, the physiotherapist must still be recognised by us for benefit purposes.

*Please note, cover for self-referral is subject to the medical underwriting on your scheme.

Outpatient complementary therapies

We will pay up to £250 per scheme year for chiropractic treatment, osteopathy and acupuncture, following GP or specialist referral, when treatment is required as a result of long COVID. You must be referred to a complementary practitioner we have recognised for benefit purpose.

Back to topWe will pay a combined limit of £20,000 per scheme year for medical necessary outpatient, daycase or inpatient treatment, in an NHS or private psychiatric unit, for mental health conditions, which we agree are eligible in writing and in advance.

Outpatient treatment

We will pay for outpatient consultations for eligible mental health conditions following GP or self-referral*.

Where treatment with a psychological therapist occurs outside our network provider it must be delivered under the direct supervision of a consultant psychiatrist.

Please refer to the mental health pathway for further information.

*Please note, cover for self-referral is subject to the medical underwriting on your scheme and under 18’s will require a referral letter from their own GP.

Inpatient and daycase treatment

We will pay for eligible inpatient and daycase mental health treatment. All treatment must be under the direct control and supervision of a consultant psychiatrist, and must be authorised by us in advance and in writing.

Back to topWe will pay in full for transport by a private ambulance to and/or from a hospital when ordered for medical reasons.

Back to topWe will pay in full for home nursing charges for registered nurses when recommended by a specialist and where treatment is:

-

medically necessary and without it you would have to receive treatment as an inpatient or daycase admission

-

needed for medical reasons (i.e. not social or domestic reasons)

-

under the direct supervision of a specialist

Mental health treatment delivered at home or in the community is not covered by the scheme.

Back to topPlease refer to the virtual GP page for further information on how to access this benefit.

Back to topThe scheme is designed to cover treatment in the UK, and therefore provides limited cover for treatment you may require whilst abroad. We strongly recommend that you ensure you have adequate travel insurance and/or a European Health Insurance Card / Global Health Insurance Card in place before you travel abroad on holiday.

If you wish to claim for emergency treatment received abroad, you must send us proof of how long you were abroad for (this period should not exceed 28 consecutive days). You should also send us all medical bills and receipts associated with your treatment. Failure to submit receipts within six months of the date of treatment may result in the claim being denied.

We will reimburse reasonable and customary costs for overseas emergency treatment as detailed below:

|

Treatment: |

Reimbursement level: |

|

Specialist fees |

Within our reasonable and customary fees |

|

MRI, CT and PET scans |

Up to £100 per trip |

|

Outpatient surgical procedures |

Up to £100 per trip |

|

Other emergency outpatient treatment (excluding MRI, CT and PET scans, and outpatient surgical procedures) |

Up to annual outpatient benefit limits, as detailed in the table of benefits |

|

Inpatient or daycase surgical procedures |

Up to £200 per trip |

We will only pay up to the above limits if the following apply:

-

the treatment is eligible for benefit

-

the treatment is carried out by a specialist who is:

-

fully trained and legally qualified and permitted to practice by the relevant authorities in the country in which your treatment takes place, and

-

is recognised by the relevant authorities in that country as having specialised knowledge of, or expertise in, treatment of the disease, illness or injury being treated; and

-

the treatment facility is specifically recognised or registered under the laws of the territory in which it stands for providing the treatment delivered.

We will not pay for overseas emergency treatment in any country if:

-

the Foreign and Commonwealth Office has advised against travel to that country or area. If you are already in the country or area when the Foreign and Commonwealth Office advises against travel, and you require treatment, this should be claimed for under your travel insurance policy

-

you are already in that particular country or area and have been advised to leave unless prior written authority has been received from us. If you are unable to leave a particular country or area after being advised to do so, and you require treatment, this should be claimed for under your travel insurance policy

-

you travelled abroad despite being given medical advice not to travel abroad

-

you travelled abroad to receive treatment, or

-

the treatment you require is related to a pre-existing condition.

The scheme will not pay for:

-

GP services or fees

-

outpatient prescriptions

-

take home drugs and dressings

-

any costs associated with an evacuation or repatriation

-

any treatment that should be free or provided at a reduced cost under a reciprocal agreement or EHIC/GHIC.

Costs of private treatment in facilities in the European Union, Iceland, Liechtenstein, Norway or Switzerland or costs in state facilities in these countries which should have been free or reduced if you had had a European Health Insurance Card / Global Health Insurance Card are not covered under the scheme.

If you are a UK resident, you are entitled to medical treatment that becomes necessary, at reduced cost or sometimes free, when temporarily visiting a European Union (EU) country, Iceland, Liechtenstein, Norway or Switzerland. Only treatment provided under the state scheme (the country’s equivalent to the NHS) is covered. However, to obtain treatment you will need to take a European Health Insurance Card (EHIC) or Global Health Insurance Card (GHIC) with you.

EHIC are still valid if in date, but they have now been replaced by the GHIC. You can apply for a GHIC by clicking here.

Your scheme will not cover you for the costs of an evacuation or repatriation should you require this. Therefore we strongly recommend that you take out appropriate travel insurance if you are going abroad to ensure that you have adequate cover for any healthcare needs you have along with cover for loss of luggage etc.

Back to topCancer cover explained - CORE

We know that a cancer diagnosis can be a life changing event. Therefore we have provided a specific section within your scheme to help you understand the level of cover available to you for cancer treatment.

The CGG provides benefit for eligible outpatient, daycase and inpatient treatment for cancer. To ensure that you receive the highest quality of care at all times we identify centres of excellence for the treatment of cancer. If you are diagnosed with cancer we may require you to transfer to one of these centres. These centres may be either in the private or NHS sector.

Should you choose to receive free eligible inpatient, daycase or outpatient treatment at an NHS centre you may be eligible for the NHS cancer cash benefit as shown on your tables of benefits.

One of our nurse case managers will be able to provide information on the treatment options available to you and support you through your treatment.

The table below provides a summary of the cancer cover available and should be read alongside your table of benefits.

Please note all benefits are subject to an overall benefit limit of £80,000 per member per scheme year.

| Summary of cancer benefits | What’s covered | What’s not covered |

| Where will I be covered to have treatment? |

You will be covered in full for eligible treatment:

|

You will not be covered for any treatment received in a hospice. |

| What diagnostic tests are covered? |

You will be covered in full for:

|

You will not be covered for any diagnostic tests that are:

|

Will I be covered for surgery? |

You will be covered in full for:

|

You will not be covered for surgery that is:

|

| Will I be covered for preventative treatment? |

You will be covered for prophylactic (preventative) surgery if:

For example, we will pay for a mastectomy to a healthy breast in the event that you have been diagnosed with cancer in the other breast and your specialist indicates that prophylactic surgery is medically necessary and will be carried at the same time as surgery to the diseased breast. You must have our written agreement before you have tests, procedures or treatment and we will need full clinical details from your consultant before we can give our decision. |

You will not be covered for any preventative treatment, including:

|

| What drug treatments will I be covered for? |

You will be covered in full for:

|

You will not be covered for:

|

| Will I be covered for radiotherapy? |

You will be covered in full for radiotherapy, including when given for pain relief. |

You will not be covered for radiotherapy that is:

|

| Will I be covered for end of life care? |

|

You will not be covered for:

|

|

What cover will be |

You will be covered for follow-up tests and specialist consultations to monitor you once you have completed treatment for a cancer. No time limits are placed on follow up tests and consultations as long as these are medically necessary and your specialist confirms this in writing |

|

|

What other benefits |

You will be covered for additional cancer therapies and services. Please see the cancer treatment benefits section in your table of benefits for full details on the additional benefits provided. |

You will not be covered for:

|

|

Are there any other supportive benefits available? |

You also have access to a comprehensive support platform delivered by Perci Health to provide you with additional support for the psychological, physical and practical impacts of cancer when it is needed most. For further information please see the your cancer support explained page. |

|

Cancer cover explained - BOOST

We know that a cancer diagnosis can be a life changing event. Therefore we have provided a specific section within your plan to help you understand the level of cover available to you for cancer treatment.

The CGG provides benefit for eligible outpatient, daycase and inpatient treatment for cancer. To ensure that you receive the highest quality of care at all times we identify centres of excellence for the treatment of cancer. If you are diagnosed with cancer we may require you to transfer to one of these centres. These centres may be either in the private or NHS sector.

Should you choose to receive free eligible inpatient, daycase or outpatient treatment at an NHS centre you may be eligible for the NHS cancer cash benefit as shown on your tables of benefits.

One of our nurse case managers will be able to provide information on the treatment options available to you and support you through your treatment.

The table below provides a summary of the cancer cover available and should be read alongside your table of benefits.

Please note cancer treatment is subject to an overall benefit limit of £100,000 per member per scheme year.

| Summary of cancer benefits | What’s covered | What’s not covered |

| Where will I be covered to have treatment? |

You will be covered in full for eligible treatment:

|

You will not be covered for any treatment received in a hospice. |

| What diagnostic tests are covered? |

You will be covered in full for:

|

You will not be covered for any diagnostic tests that are:

|

| Will I be covered for surgery? |

You will be covered in full for:

|

You will not be covered for surgery that is:

|

| Will I be covered for preventative treatment? |

You will be covered for prophylactic (preventative) surgery if:

|

You will not be covered for any preventative treatment, including:

|

| What drug treatments will I be covered for? |

You will be covered in full for:

|

You will not be covered for:

|

| Will I be covered for radiotherapy? |

You will be covered in full for radiotherapy, including when given for pain relief. |

You will not be covered for radiotherapy that is:

|

| Will I be covered for end of life care? |

|

You will not be covered for:

|

|

What cover will be |

You will be covered for follow-up tests and specialist consultations to monitor you once you have completed treatment for a cancer. No time limits are placed on follow up tests and consultations as long as these are medically necessary and your specialist confirms this in writing |

|

|

What other benefits |

You will be covered for additional cancer therapies and services. Please see the cancer treatment benefits section in your table of benefits for full details on the additional benefits provided. |

You will not be covered for:

|

|

Are there any other supportive benefits available? |

You also have access to a comprehensive support platform delivered by Perci Health to provide you with additional support for the psychological, physical and practical impacts of cancer when it is needed most. For further information please see the your cancer support explained page. |

Your cancer support explained

We know that a cancer diagnosis can be a life changing event and we are committed to supporting you in the event that you are impacted by cancer. This is why we have partnered with Perci Health to provide you with additional support for the psychological, physical and practical impacts of cancer.

Perci are able to offer you support regardless of how you have been impacted by cancer

- Are you receiving active treatment for a cancer diagnosis?

- Are you looking for some additional support following completion of your cancer treatment?

- Are you caring for a loved one with cancer?

Regardless of your situation, Perci are able to provide a personalised care plan, a dedicated cancer nurse, and access to caring cancer experts from over 20 different support types to help reduce the impact of cancer.

| Recovery and rehabilitation | Symptom management | Support for carers |

|

|

|

Access to this service will not be subject to an excess, scheme underwriting or any healthcare scheme benefit limits, if any apply.

Please note; this benefit is available to members over the age of 18.

For further information and to get started access the ‘your cancer support’ tile on the Member Zone or the My Healix app.

COVID-19 cover explained

In the event that you require immediate, acute treatment for COVID-19 this must take place on the NHS, and you may be able to claim NHS COVID Cash Benefit, if this is detailed in your table of benefits.

You will be covered for non-urgent eligible treatment arising from COVID-19 (commonly referred to as “long COVID”). One of our nurse case managers will be able to provide information on the treatment options available to you, and support you through your treatment.

The following table provides a summary of the cover available and should be read alongside your table of benefits. Cover for long COVID is subject to a limit of £5,000 per member per scheme year up to a maximum lifetime benefit of £15,000.

| Summary of cancer benefits | What’s covered | What’s not covered |

| Where will I be covered to have treatment? |

You will be covered up to the benefit limit for eligible outpatient, daycase or inpatient treatment:

|

You will not be covered for:

|

| What tests will I be covered for? |

You will be covered up to the benefit limit for:

|

You will not be covered for any tests that are:

|

| What other benefits and services are available? |

You will be covered within the overall benefit limit for:

|

You will not be covered for:

|

Fertility treatment explained

We know that fertility concerns can have a major impact on life so we have developed a benefit to offer support and assistance when it matters most.

One of our experienced claims assessors will be able to provide information on the treatment options available to you and support you through your treatment.

The table below provides a summary of the cover available and should be read alongside your table of benefits.

The following benefits are only eligible for individuals who are covered by the healthcare scheme and are under the age of 43.

| Summary of benefits | What is covered |

|

Who can receive treatment? |

You will be covered within the benefit limit for fertility treatment providing you are a member of the healthcare scheme and under the age of 43 years. You must be under the age of 43 at the beginning of each individual treatment cycle. Should you turn 43 during treatment, cover will be available up to the end of the current treatment cycle only. |

|

When is cover eligible from? |

You will be covered within the benefit limit for ART after completion of a 12 month waiting period which starts from the date you join the healthcare scheme. |

|

Where am I covered to receive treatment? |

You will be covered within the benefit limit for treatment in the UK at a facility approved for use and licensed by the HFEA (Human Fertilisation and Embryology Authority) |

|

What treatments am I covered for? |

You will be covered within the benefit limit for surgery for the following conditions where this is affecting your fertility and is recommended by a specialist:

You will be covered within the benefit limit for eligible assisted reproductive technology (ART) treatment including:

These treatments will be eligible for cover where treatment has been recommended by a specialist You will also be covered for:

Most fertility treatment costs are attributed to the female. As a male claimant you will be eligible for the following treatment:

|

|

Am I covered for surgical sperm extraction? |

You will be covered within the benefit limit for the costs associated with surgical sperm extraction when medically necessary and recommended by a specialist |

|

How many cycles of IVF / IUI am I covered for? |

You will be covered within the benefit limit for repeated cycles of IUI / IVF / ICSI / FET. |

|

Am I covered for the genetic testing of eggs / sperm / embryos? |

You will not be covered for any costs associated with genetic testing (including, but not limited to, karyotype testing or pre implantation genetic testing) |

|

Am I covered for sperm washing? |

You will not be covered for the cost of sperm washing to prevent blood borne viruses from being transmitted. |

|

Am I covered for the cost of take home drugs |

You will be covered within the benefit limit for the cost of fertility medications required for the purpose of providing the fertility treatment and prescribed by your specialist as part of your ART up until the point that a pregnancy is confirmed by ultrasound scan. Cover is available for the following:

Cover is NOT available for:

Following confirmation of a viable pregnancy, the cost of any further medication required to maintain the pregnancy will not be eligible for benefit. |

|

Am I covered for donor insemination / donor eggs? |

You will not be covered for the cost of donor eggs or sperm required to achieve a pregnancy. |

|

Am I covered for the costs of surrogacy? |

You will not be covered for the costs of ART with the use of a surrogate. |

|

Am I covered for the cost of freezing resultant embryos following IVF treatment? |

You will be covered within the benefit limit for the costs of embryo freezing for a total of 12 months following a cycle of IVF – after which time any further costs associated with the continued storage of embryos will no longer be eligible for cover |

|

When does cover end? |

Cover for ART will end at the point that a viable pregnancy is confirmed by ultrasound scan or when the benefit limit has been reached, whichever is reached soonest. Once a pregnancy has been confirmed, any further scans or pregnancy related treatment will need to be taken on the NHS and the pregnancy exclusion would apply |

|

Am I covered for treatment ‘add ons’ recommended by the clinic? |

You will be covered within the benefit limit for the cost of treatment ‘add ons’ only where there is adequate evidence as to their effectiveness as defined by the HFEA. |

|

Am I covered to freeze my eggs / sperm to use at a later time in life? |

You will not be covered for the cost of egg or sperm freezing in order to preserve fertility for use at a later time in life. |

|

Are same sex couples and individuals not in a partnership eligible for ART? |

You will be covered within the benefit limit for treatment recommended by a specialist, however, the costs of the associated donor sperm or eggs required to achieve a pregnancy will not be eligible for cover. |

|

Can I continue treatment that I started through self-pay prior to joining the healthcare scheme? |

You will be covered within the benefit limit for the continuation of eligible pre-paid treatment. Treatment costs already incurred prior to the benefit being eligible will not be reimbursed. |

|

Am I covered for reversal of sterilisation to correct infertility? |

You will not be covered for the cost of sterilisation reversal where this is the cause of infertility in either partner. |

|

Am I covered for complementary therapies related to fertility? |

You will be covered for complementary therapies as detailed in your table of benefits. |

|

Am I covered for counselling or mental health treatment related to my infertility? |

You will be covered for mental health treatment as detailed in your table of benefits. |

|

Am I covered for multi-cycle treatment packages? |

You will be covered within the benefit limit for the cost of single cycle treatment only. We are unable to cover ‘multi-cycle package’ costs that may not be used. |

|

Do I need to self-pay for treatment |

You may be required to self-pay for treatment at a fertility clinic where they are unable to accept payment from Healix. Eligible treatment can then be reimbursed from Healix as long as this is requested within 6 months of the treatment date. Reimbursement can only be made after the treatment has taken place. |

Second medical opinion

Should you decide that you would like to receive a second medical opinion to ensure you are fully confident with your specialists recommendations please contact us on the claims helpline to discuss pre-authorisation. Our team of nurse case managers will be able to advise and support you through this process.

Second medical opinions will be arranged with a specialist who is an expert in their field and is recognised for the purposes of providing such second opinions. Following your second medical opinion your nurse case manager will contact you to discuss the suggested treatment plan and eligibility for benefit. Without written authorisation for a second opinion payment cannot be made for any recommended or resulting treatment.

Virtual GP

As part of your scheme you have access to a virtual GP service, called YourHealth247, which is provided by Teladoc.

You can register for this service via their portal, which can be found at:

http://www.yourhealth247.co.uk/

The portal is the fastest and easiest way to register for the virtual GP service and book your consultations. If you do not have access to the portal, you can also call YourHealth247 on 0204 586 5324.

To register, you will need your member number. This can be found on your welcome or renewal email.

Should YourHealth247 refer you onto a specialist, please contact us on the claims helpline to check if this is eligible under your scheme. Any onward referrals are subject to your scheme underwriting and personal exclusions (if applicable) and general scheme exclusions. Should further information on your past medical history be required, we will need your consent to contact your NHS GP.

Section 9: Glossary

The words and phrases below have the following meanings. They will appear in bold in this guide.

Active treatment

Acute condition

Annual renewal date

Benefit

Benefits

Biological therapies

Cancer

Chronic condition

Complementary practitioner

- Acupuncture practitioners must be registered with the BMAS (British Medical Acupuncture Society), BacC (British Acupuncture Council), AACP (Acupuncture Association of Chartered Physiotherapists) or AAC (The Association of Acupuncture Clinicians)

- Osteopaths must be registered with the GOsC (General Osteopathic Council)

- Chiropractors must be registered with the GCC (General Chiropractic Council) <

Daycase

Dependant

-a member’s unmarried dependent children if under the age of 25 – they will be removed from cover on the next annual renewal date following their 25th birthday. The dependent children must be living full-time at the same address as the main member, unless they are in further education.

Dependants

-a member’s unmarried dependent children if under the age of 25 – they will be removed from cover on the next annual renewal date following their 25th birthday. The dependent children must be living full-time at the same address as the main member, unless they are in further education.

Dialysis

- haemodialysis, (through the use of a kidney machine or dialyser)

- peritoneal dialysis (by introducing fluid into the abdomen to act as a filter). <

Disorder

Emergency

Employer

End of life care

Gender Dysphoria

Gender Incongruence

General Practitioner

GP

High dependency unit

High risk activities

Home healthcare

Hospital

Private hospital - an independent hospital which can provide acute medical, surgical or psychiatric care. It must be registered under The Registered Homes Act (1984) and approved by the Healthcare Commission or any future law. It may also include a private bed in an NHS hospital.

Inpatient

Intensive care unit

Medical condition

Medically necessary

-

In accordance with professional standards of medical practice in the United Kingdom

-

Clinically appropriate, in terms of type, frequency, extent, site and duration of treatment

-

Required for reasons other than the comfort or convenience of the patient or specialist.

-

Provided at an appropriate facility, in an appropriate setting and at an appropriate level of care for the treatment of the patient’s medical condition.

-

Provided only for an appropriate duration of time.

-

No more costly than an alternative treatment at least as likely to produce the same therapeutic or diagnostic results.

<

Members

Mental health condition

Outpatient

Palliative care

Partner

Physiotherapist

Pre-existing condition

-

you have received medication, advice or treatment, or

-

you have experienced symptoms whether the condition was diagnosed or not.

<

Private ambulance

Prosthesis

Psychological therapist

-

a psychologist who is:

-

Registered with the Health and Care Professions Council (HCPC);

-

Registered with the British Psychological Society (BPS) as a chartered Psychologist

-

a therapist who is:

-

An accredited member of the British Association of Counselling and Psychotherapy (BACP); or

-

An Accredited Member of the British Association for Behavioural and Cognitive Psychotherapies (BABCP); or

-

An Accredited Member of Scotland’s Professional Body for Counselling and Psychotherapy (COSCA); or

-

A practitioner who is registered with the United Kingdom Council for Psychotherapy (UKCP)

Registered nurse

Related condition

Specialist

- a medical practitioner with full current registration with the General Medical Council or

-

a dentist with full current registration with the General Dental Council

and

-

a specialist in the treatment you are referred for (this is applicable to all specialities including anaesthetics and psychiatry)

-

has a certificate of Higher Specialist Training in their specialty that is issued by the Higher Specialist Training Committee of the appropriate Royal College or Faculty

-

is or has been a National Health Service consultant or dentist

-

has been recognised for benefit purposes as a specialist by Healix.

<

Start date

Surgical appliance

The Scheme

Practitioner

- an occupational therapist

- an orthoptist

- a speech and language therapist

- a dietician or;

- a nurse who is on the register of the Nursing and Midwifery Council (NMC) and holds a valid NMC personal identification number. <

Treatment

Treatments

Trust Deed

Trustee, Trustees

United Kingdom

Waiting Period

We, Us, Our

You, Your

Scheme

Pandemic

Epidemic

Member Zone

Member

Neurodevelopmental disorders

Women's health services

At Healix, we know it’s vital to receive quick access to healthcare, we have therefore made access to women’s health services as easy and smooth as possible. Whenever you are experiencing a women’s health concern, you can consult with a GP with additional training in women’s health, via the Virtual GP Service. To access this benefit, please see the Virtual GP page.

Alternatively contact the claims helpline, and speak to a member of our experienced claims team, they will be able to guide you to the most appropriate services, including access to a remote advice service with a gynaecologist.