Introduction

Welcome to the RAC Cash Plan Guide.

RAC have appointed us, Healix Health Services Ltd, to administer this cash plan, therefore when you see the words “we”, “us” or “our” in this guide it means Healix.

The cash plan is designed to help with some of the costs of everyday healthcare expenses, on a pay and claim basis, as well as cover a range of benefits designed to help support your overall health and wellbeing such as specialist scans.

This guide will take you through how the plan works, which includes:

-

How to claim

-

How your cash plan is managed, and

-

Cover which is available under this plan

Please note, some treatments are excluded, please refer to the cash plan exclusions for further details.

All treatment needs to be carried out by a registered and qualified practitioner. If you are unsure about the qualifications needed please refer to the benefit notes in the table of benefits. If you need any further clarification, please call our helpline.

Table of benefits

Your healthcare plan benefits are set out in the table below. Please note, you will only be eligible to claim for the below benefits if you have selected to join the plan.

Benefit limits apply to each individual member or dependant in any one year of cover, unless otherwise stated.

Your plan year runs from 1st July 2025 to 30th June 2026.

| Lifestyle | Level of cover | Benefit note |

Dental |

Up to £100 per plan year | 1 |

Optical |

Up to £75 per plan year | 2 |

Prescriptions |

Up to 2 items per plan year | 3 |

| Prevention | ||

Flu vaccination |

Up to £15 per plan year | 4 |

Travel vaccinations |

Up to £15 per plan year | 5 |

Health screening |

Up to £100 per plan year | 6 |

Cholesterol and heart check |

Up to £15 per plan year | 7 |

Diabetes check |

Up to £15 per plan year | 8 |

| Hospital | ||

Outpatient private hospital treatment |

Up to £500 per plan year | 9 |

| Health and Wellbeing | ||

Therapies |

Up to £150 per plan year | 10 |

Health and wellbeing |

Up to £100 per plan year | 11 |

Fitness and exercise |

Access to discounted Nuffield gym membership | 12 |

Note: The above benefits only apply when the covered person has treatment in the UK.

The benefit is available when you pay the provider and submit your claim form and original receipts within 6 months of the treatment date.

We will reimburse you 100% of the cost of treatment up to the maximum benefit limit available to you each plan year.

The benefit is available having undergone treatment with a qualified dentist or dental hygienist.

This benefit is available for:

-

routine dental check-ups

-

dental crowns, bridges and fillings

-

hygienist fees

-

x-rays (including emergency treatment)

-

orthodontic treatment and braces

-

dental anaesthetic fees

-

dentures

Exception: benefit is not available for cosmetic dentistry unless it is as a direct result of a dental accident or illness

Back to topWe will reimburse you up to the maximum benefit available per person, per plan year.

This benefit is available for:

-

routine eyesight tests

-

prescription spectacles, and sunglasses and/or contact lenses (including repairs)

-

prescription lenses to an existing frame (including solutions)

-

laser eye surgery

Exception: benefit is not available for non-prescribed glasses and lenses and associated costs.

Please note this benefit is only available on a pay and claim basis when provided by a qualified ophthalmic practitioner/surgeon.

Back to topWe will reimburse you 100% of the cost of a prescription up to the maximum benefit available to you each plan year. This benefit covers the cost of two prescribed items.

The benefit is available when you pay a prescription charge directly to a pharmacy and obtain a receipt.

The benefit is available for:

-

medically necessary NHS or private prescriptions provided by your GP, Optician or Dentist.

We will reimburse you 100% of the cost of your vaccination up to the maximum benefit available to you each plan year.

This benefit is available to you to cover the cost of one private flu vaccination once a year, up to the value of the benefit limit.

Back to topWe will reimburse you 100% of the cost of your travel vaccinations up to the maximum benefit available to you each plan year.

This benefit is available to you to cover the cost of one set of travel vaccinations per year, up to the value of the benefit limit.

Back to topWe will reimburse you 100% of the cost of a health screen up to the maximum benefit available to you each plan year.

This benefit is available to you towards one health screen per year, up to the value of the benefit limit.

This benefit is available for:

-

full health screen

-

specific health screen e.g. mammogram

We will reimburse you 100% of the cost of a cholesterol and heart check up to the maximum benefit available to you each plan year.

This benefit is available to you towards the cost of one cholesterol and heart check per year, up to the value of the benefit limit.

Back to topWe will reimburse you 100% of the cost of a Diabetes check up to the maximum benefit available to you each plan year.

This benefit is available to you towards the cost of one diabetes check per year, up to the value of the benefit limit.

Back to topWe will reimburse you 100% of the cost of outpatient hospital treatment up to the maximum benefit available to you each plan year when referred by a GP or specialist.

The benefit is available when you pay a registered practitioner or private hospital charges relating to:

-

outpatient consultations with a specialist

-

x-ray’s, pathology and ultrasounds

-

MRI, CT or other specialist scans

-

ECG’s and other outpatient tests and procedures

We will reimburse you 100% of the cost of treatment up to the maximum benefit available to you each plan year.

This benefit is available if you receive treatment from and pay directly a registered therapist who is a member of an approved professional organisation.

This includes physiotherapy, acupuncture, chiropractic treatment, osteopathy, sports therapist, chiropody and homeopathy treatment.

To ensure that you choose the most appropriate treatment we strongly recommend that you take advice from your GP or specialist.

Back to topWe will reimburse you 100% of the cost of the following treatment up to the maximum benefit available to you per plan year.

This benefit is available if you receive treatment from and pay directly a registered therapist, practitioner or specialist who is a member of an approved professional organisation. This includes allergy testing, cognitive behavioural therapy and counselling.

To ensure that you choose the most appropriate treatment we strongly recommend that you take advice from your GP or specialist.

Back to topThrough your cash plan you can enjoy a 10% discounted gym membership with Nuffield Health, who have 111 fitness and wellbeing clubs nationwide.

Back to topWhat is covered?

The RAC Cash Plan will cover the cost of treatment as shown in the table of benefits if you are a permanent resident in the UK, and if you receive treatment from:

-

a specialist (covered under the plan’s terms and conditions) that has been referred by your GP.

-

a qualified dentist

-

a qualified optician

-

a qualified therapist for – Physiotherapy, Chiropractic, Acupuncture, Chiropody and Osteopathy treatment

All claim forms and original receipts need to be submitted within 6 months of the treatment date.

Virtual GP

As part of your scheme you have access to a virtual GP service, called YourHealth247, which is provided by Teladoc.

You can register for this service via their portal, which can be found at:

http://www.yourhealth247.co.uk/

The portal is the fastest and easiest way to register for the virtual GP service and book your consultations. If you do not have access to the portal, you can also call YourHealth247 on 0204 586 5324.

To register, you will need your member number. This can be found on your welcome or renewal email.

Should YourHealth247 refer you onto a specialist, please contact us on the claims helpline to check if this is eligible under your scheme. Any onward referrals are subject to your scheme underwriting and personal exclusions (if applicable) and general scheme exclusions. Should further information on your past medical history be required, we will need your consent to contact your NHS GP.

Exclusions and limitations

The following is an explanation of all treatments that are not covered under the Cash Plan. If you are unsure about anything in this section, please contact us on the claims helpline.

Benefit is not available for:

-

Cancellation charges made by the dentist (missed appointments)

-

Teeth whitening

-

Dental consumables – the supply of physical aids or devices (including but not limited to tooth brushes, dental floss, mouth wash etc).

-

Cosmetic dental procedures – unless a result of an accident or illness

Benefit is not available for:

- Non-prescribed glasses and contact lenses

Benefit is not available for:

-

Any treatment provided by a practitioner who is not recognised by us.

-

Missed appointment fees

-

Any herbal remedies, supplements, vitamins etc even if recommended or supplied by your practitioner

-

Any diagnostic scans

-

Appliances (braces, supports, lumbar rolls etc)

Section 9: Glossary

The words and phrases below have the following meanings. They will appear in bold in this guide.

Annual renewal date

Benefit

Benefits

Complementary practitioner

- Acupuncture practitioners must be registered with the BMAS (British Medical Acupuncture Society), BacC (British Acupuncture Council), AACP (Acupuncture Association of Chartered Physiotherapists) or AAC (The Association of Acupuncture Clinicians)

- Osteopaths must be registered with the GOsC (General Osteopathic Council)

- Chiropractors must be registered with the GCC (General Chiropractic Council) <

Daycase

Dependant

-a member’s unmarried dependent children

Dependants

-a member’s unmarried dependent children

Emergency

Employer

General Practitioner

GP

High risk activities

Hospital

Private hospital - an independent hospital which can provide acute medical, surgical or psychiatric care. It must be registered under The Registered Homes Act (1984) and approved by the Healthcare Commission or any future law. It may also include a private bed in an NHS hospital.

Inpatient

Medically necessary

-

In accordance with professional standards of medical practice in the United Kingdom

-

Clinically appropriate, in terms of type, frequency, extent, site and duration of treatment

-

Required for reasons other than the comfort or convenience of the patient or specialist.

-

Provided at an appropriate facility, in an appropriate setting and at an appropriate level of care for the treatment of the patient’s medical condition.

-

Provided only for an appropriate duration of time.

-

No more costly than an alternative treatment at least as likely to produce the same therapeutic or diagnostic results.

<

Members

Mental health condition

Outpatient

Plan

Year of cover

Daycase treatment

Outpatient treatment

Partner

Dental hygienist

Physiotherapist

Dentist

Specialist

- a medical practitioner with full current registration with the General Medical Council or

-

a dentist with full current registration with the General Dental Council

and

-

a specialist in the treatment you are referred for (this is applicable to all specialities including anaesthetics and psychiatry)

-

has a certificate of Higher Specialist Training in their specialty that is issued by the Higher Specialist Training Committee of the appropriate Royal College or Faculty

-

is or has been a National Health Service consultant or dentist

-

has been recognised for benefit purposes as a specialist by Healix.

<

The Plan

Therapist

-

a Chartered Physiotherapist

-

an Occupational Therapist registered with the British Association of Occupational Therapists

-

an Orthoptists registered with the British and Irish Orthoptic Society

-

a Speech and Language Therapist registered with the Royal College of Speech and Language Therapists

-

a dietician registered with the British Dietetic Association

<

Treatment

Treatments

Trust Deed

Trustee, Trustees

United Kingdom

We, Us, Our

You, Your

Member Zone

Member

Making a claim

Download the My Healix app

Access the Member Zone

Click here to access the Member Zone using your individual member number where you can register a new claim.

When submitting a claim for these benefits you are required to complete a claim form. This can be completed online via the Member Zone or the My Healix app.

Pay and claim benefits include:

- Dental treatment

- Dental injury treatment

- Optical treatment

- Consultations and diagnostic tests

- Hospital charges for inpatient or daycase treatment

- Therapies (physiotherapy, osteopathy, chiropractic, chiropody/podiatry, acupuncture)

- Prescriptions

- Health assessment (main member only)

When claiming for this treatment you must send all receipts and invoices to us within 6 months of the treatment date, with a completed claim form. As this plan has been designed to reimburse you after you have paid a provider, we cannot pay a provider directly.

Please review your table of benefits to see what benefits are available to you, and any limitations which may apply.

How to claim summary

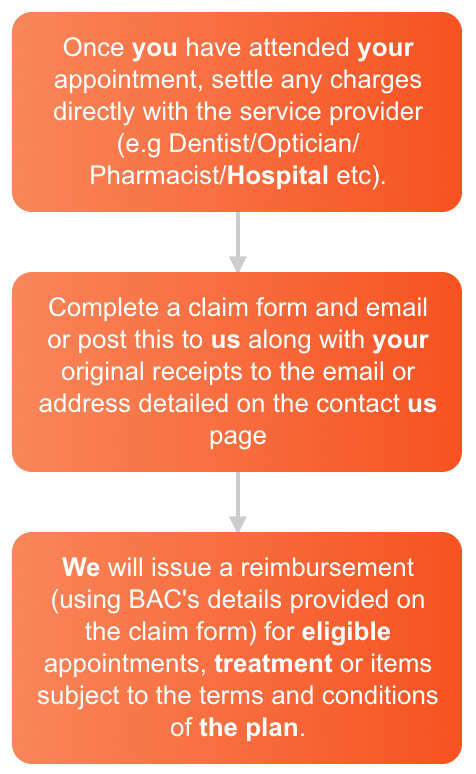

Once you have attended your appointment, settle any charges directly with the service provider (e.g Dentist/Optician/ Pharmacist/Hospital etc).

Complete an online claim form through the Member Zone or the My Healix app.

We will issue a reimbursement (using BAC's details provided on the claim form) for eligible appointments, treatment or items subject to the terms and conditions of the plan. For all complete and eligible claims, reimbursement will be processed within 10 working days of receipt of the claim form.

P11d

The RAC Cash Plan is paid for by RAC and is deemed a benefit in kind and therefore taxable.

The employee will be taxed on the £50 contribution made by RAC. The tax is calculated on the employee’s taxable rate and which is then divided over a 12 month period.

For example, if you are paying 20% tax your benefit in kind will be 20% of £50 = £10 which is then divided by 12 months to give you £0.83 pence taxable benefit per month.

Your personal tax code, and personal allowance will be adjusted to take account of this benefit, and the tax will be collected monthly in the form of income tax.

Please note, you can add dependants onto the RAC Cash Plan - Flex at an extra cost, please speak with your HR department if this is of interest.

FAQ

1. What is a health cash plan?

Healthcare cash plans are insurance policies that instead of covering you for unforeseen, unpredictable events like most other types of insurance, help you pay for the cost of routine healthcare.

Healthcare cash plans are not full-blown private medical insurance policies – they meet all or some of the cost of treatments. These include dental and optical treatment and treatments such as physiotherapy.

2. Why use a cash plan?

A healthcare cash plan allows you to claim money back, up to set limits, towards the cost of your essential healthcare. It’s a great way to help you budget for your everyday health costs. From dental appointments to optical check-ups, therapy treatment and more, you can be rest assured that your cover will help with your bills.

A healthcare cash plan also provides access to valuable health and wellbeing services, for those unexpected health issues and to help keep you at your fit and healthy best.

Some examples;

Dental – There is a strong link between oral health and general health. It is recommended that you have a check-up every six months or as your dentist may suggest. The RAC Healthcare Cash Plan can support you with the costs associated with this. You just need to book your check-up and pay as normal, but retain your receipt. You can then use the RAC Healthcare Cash Plan to claim back the cost of your check-up. All you need to do is complete a claim form, and send this into us along with your original receipt and you will receive reimbursement. You can claim up to a maximum of £100.00 in any one policy year for not only check-ups but also for dental treatment. See the RAC Healthcare Cash Plan benefits table which details what can be claimed.

MRI scan (private hospital) – Should you be recommended by your GP for an MRI scan, rather than waiting for the NHS you can use private hospital facilities. You can book the scan to speed up this process and claim up to £500 towards the cost of this. All you need to do is complete a claim form, and send this to us, along with your original receipt and you will receive reimbursement.

3. How do I join the RAC Cash Plan?

The RAC Healthcare Cash Plan is a company funded, colleague only scheme and accessible to colleagues under the Performance Related Pay Review (PRP). PRR new joiners are covered from their start date, please note access to the site and information regarding the scheme will be sent once you’re received your first salary.

4. Can I opt out of the RAC cash plan?

Any opt out request must be received within 14 days of the policy commencing – 1st July each year (new joiners – from your start date). If you wish to opt out please complete the ‘Opt Out Form’ which can be accessed by clicking here, and email the completed form to the RAC Reward team on Reward@rac.co.uk. Please note you may only opt out of scheme if no claims have been made or processed under the scheme. Requests to opt out outside of this period will not be approved. The next opportunity to opt out will be next July.

5. How does it work and how do I claim?

The cash plan is so easy to use. Simply receive and pay for your healthcare treatment as normal (where applicable), keep hold of your receipt and send it into us, together with your claim form within 26 weeks. We aim to process correctly presented claims within 10 working days of receipt of the claim form and payment will be made directly into your bank account – it’s that quick and easy. You must receive diagnosis or treatment from a fully qualified GP, consultant or practitioner who is registered with, or a member of, the relevant professional bodies as specified in the definitions section within the healthcare cash plan booklet.

6. Can I claim straightaway?

You will be able to claim for most of the benefits contained with the healthcare cash plan from the start of your cover.

7. How many claims can I make?

There is no limit to the number of claims you can make, up to the maximum allowance for each benefit.

8. What happens if I leave?

Your cash plan cover will cease on your leave date from the company. Please note claims received after this date will not be processed.

Section 9: Glossary

The words and phrases below have the following meanings. They will appear in bold in this guide.

Annual renewal date

Benefit

Benefits

Complementary practitioner

- Acupuncture practitioners must be registered with the BMAS (British Medical Acupuncture Society), BacC (British Acupuncture Council), AACP (Acupuncture Association of Chartered Physiotherapists) or AAC (The Association of Acupuncture Clinicians)

- Osteopaths must be registered with the GOsC (General Osteopathic Council)

- Chiropractors must be registered with the GCC (General Chiropractic Council) <

Daycase

Dependant

-a member’s unmarried dependent children

Dependants

-a member’s unmarried dependent children

Emergency

Employer

General Practitioner

GP

High risk activities

Hospital

Private hospital - an independent hospital which can provide acute medical, surgical or psychiatric care. It must be registered under The Registered Homes Act (1984) and approved by the Healthcare Commission or any future law. It may also include a private bed in an NHS hospital.

Inpatient

Medically necessary

-

In accordance with professional standards of medical practice in the United Kingdom

-

Clinically appropriate, in terms of type, frequency, extent, site and duration of treatment

-

Required for reasons other than the comfort or convenience of the patient or specialist.

-

Provided at an appropriate facility, in an appropriate setting and at an appropriate level of care for the treatment of the patient’s medical condition.

-

Provided only for an appropriate duration of time.

-

No more costly than an alternative treatment at least as likely to produce the same therapeutic or diagnostic results.

<

Members

Mental health condition

Outpatient

Plan

Year of cover

Daycase treatment

Outpatient treatment

Partner

Dental hygienist

Physiotherapist

Dentist

Specialist

- a medical practitioner with full current registration with the General Medical Council or

-

a dentist with full current registration with the General Dental Council

and

-

a specialist in the treatment you are referred for (this is applicable to all specialities including anaesthetics and psychiatry)

-

has a certificate of Higher Specialist Training in their specialty that is issued by the Higher Specialist Training Committee of the appropriate Royal College or Faculty

-

is or has been a National Health Service consultant or dentist

-

has been recognised for benefit purposes as a specialist by Healix.

<

The Plan

Therapist

-

a Chartered Physiotherapist

-

an Occupational Therapist registered with the British Association of Occupational Therapists

-

an Orthoptists registered with the British and Irish Orthoptic Society

-

a Speech and Language Therapist registered with the Royal College of Speech and Language Therapists

-

a dietician registered with the British Dietetic Association

<

Treatment

Treatments

Trust Deed

Trustee, Trustees

United Kingdom

We, Us, Our

You, Your

Member Zone

Member

End of cover

Cover for you (the member) will end in the following situations:

-

if your employment with RAC has come to an end for any reason

-

if you or any of your dependants have given us misleading information, have kept something from us, or have broken the conditions of this plan

-

if you no longer live full time in the United Kingdom

-

if you pass away

-

if for any reason you or RAC ask us to end cover.

If your cover ends, your dependants cover will also end on the same day as your cover.

Cover for dependants will end in the following situations:

Your partner's cover will end:

-

if you get divorced, or your civil partnership is dissolved. Cover for your partner will end as soon as the final decree/final dissolution order has been granted.

-

if you no longer live together, then your partner will no longer be considered a dependant for the purposes of this plan.

Your dependant child’s cover will end:

-

after they have turned 25. They will be removed from cover on the next annual renewal date following their 25th birthday.

-

if they get married, then they will no longer be considered a dependant for the purposes of this plan.

- if they no longer live full time in the United Kingdom

Please note, we will cover a maximum of 4 children under the plan.

Members must inform their HR Department as soon as possible of any changes of this matter.

If you have received treatment post your lapse date, you will be responsible for any treatment costs.

How to make a complaint

It is always our intention to provide a first class standard of service: however, we recognise that on occasions, your requirements may not have been met.

Should you have any cause for complaint, you should contact us.

How your complaint will be handled

Stage 1

You will receive a written acknowledgement of your complaint within five business days of receipt. This will include the name and job title of the individual handling the complaint.

Stage 2

Within four weeks of receiving your complaint, you will receive either:

-

A final response or

-

A holding response, explaining why we are not yet in a position to resolve the complaint and indicating when we will be making further contact (this will be within eight weeks from receiving the complaint).

Stage 3

If you have not received a final response within four weeks, by the end of eight weeks after receipt of the complaint, you will receive either:

-

A final response.

-

A response explaining why we are still not in a position to provide a final response and explaining when we believe we will be able to do so.

-

If we are unable to provide a final response, due to the delay which has now occurred, you may refer your complaint to the Trustees.

If, during stage 2 or 3, we issue our final response but you remain dissatisfied, you may refer your complaint to the Trustees. To do this, please set out your reasons fully in writing to the Operations Director, asking for referral to the trustees for further consideration.

Reimbursement Payments

All claims must be submitted within six months of your treatment date or within six months of the end of the scheme year you wish to claim against. Any claims submitted after this, will be assessed on a case by case basis, and paid at our discretion.

We will not pay for claims:

- if the invoice or reimbursement claim (including cash benefit claims) is not submitted within six months of your treatment date / birth or adoption date or within 6 months of the end of the scheme year you wish to claim against - whichever comes soonest.

- if the treatment takes place after you have left the scheme

- if you break any terms and conditions of your membership

- if you incur a fee for non-attendance or late cancellations.

Healix Privacy Notice

If you would like to know more about how Healix store and process your personal data, please find our Privacy Notice by clicking here.

Section 9: Glossary

The words and phrases below have the following meanings. They will appear in bold in this guide.

Annual renewal date

Benefit

Benefits

Complementary practitioner

- Acupuncture practitioners must be registered with the BMAS (British Medical Acupuncture Society), BacC (British Acupuncture Council), AACP (Acupuncture Association of Chartered Physiotherapists) or AAC (The Association of Acupuncture Clinicians)

- Osteopaths must be registered with the GOsC (General Osteopathic Council)

- Chiropractors must be registered with the GCC (General Chiropractic Council) <

Daycase

Dependant

-a member’s unmarried dependent children

Dependants

-a member’s unmarried dependent children

Emergency

Employer

General Practitioner

GP

High risk activities

Hospital

Private hospital - an independent hospital which can provide acute medical, surgical or psychiatric care. It must be registered under The Registered Homes Act (1984) and approved by the Healthcare Commission or any future law. It may also include a private bed in an NHS hospital.

Inpatient

Medically necessary

-

In accordance with professional standards of medical practice in the United Kingdom

-

Clinically appropriate, in terms of type, frequency, extent, site and duration of treatment

-

Required for reasons other than the comfort or convenience of the patient or specialist.

-

Provided at an appropriate facility, in an appropriate setting and at an appropriate level of care for the treatment of the patient’s medical condition.

-

Provided only for an appropriate duration of time.

-

No more costly than an alternative treatment at least as likely to produce the same therapeutic or diagnostic results.

<

Members

Mental health condition

Outpatient

Plan

Year of cover

Daycase treatment

Outpatient treatment

Partner

Dental hygienist

Physiotherapist

Dentist

Specialist

- a medical practitioner with full current registration with the General Medical Council or

-

a dentist with full current registration with the General Dental Council

and

-

a specialist in the treatment you are referred for (this is applicable to all specialities including anaesthetics and psychiatry)

-

has a certificate of Higher Specialist Training in their specialty that is issued by the Higher Specialist Training Committee of the appropriate Royal College or Faculty

-

is or has been a National Health Service consultant or dentist

-

has been recognised for benefit purposes as a specialist by Healix.

<

The Plan

Therapist

-

a Chartered Physiotherapist

-

an Occupational Therapist registered with the British Association of Occupational Therapists

-

an Orthoptists registered with the British and Irish Orthoptic Society

-

a Speech and Language Therapist registered with the Royal College of Speech and Language Therapists

-

a dietician registered with the British Dietetic Association

<

Treatment

Treatments

Trust Deed

Trustee, Trustees

United Kingdom

We, Us, Our

You, Your

Member Zone

Member

Contacting us

The Healix Team

Whilst it is important for you to read and understand your policy benefits and limitations, we understand that it is often easier to call us to obtain information.

Should you have any queries regarding the RAC Cash Plan, we have a team of assessor’s available to advise and help you, who can be contacted on the helpline number below:

Email: RAC@healix.com

Monday-Friday 08.00-19.00 (Excl. bank holidays)

Saturday 09.00-13.00

Telephone calls to and from our organisation are recorded for the purposes of quality and training.

Any correspondence should be sent to the following address:

RAC Cash Plan

Claims Administration Department

Healix Health Services

Healix House, Esher Green

Esher, Surrey

KT10 8AB

Section 9: Glossary

The words and phrases below have the following meanings. They will appear in bold in this guide.

Annual renewal date

Benefit

Benefits

Complementary practitioner

- Acupuncture practitioners must be registered with the BMAS (British Medical Acupuncture Society), BacC (British Acupuncture Council), AACP (Acupuncture Association of Chartered Physiotherapists) or AAC (The Association of Acupuncture Clinicians)

- Osteopaths must be registered with the GOsC (General Osteopathic Council)

- Chiropractors must be registered with the GCC (General Chiropractic Council) <

Daycase

Dependant

-a member’s unmarried dependent children

Dependants

-a member’s unmarried dependent children

Emergency

Employer

General Practitioner

GP

High risk activities

Hospital

Private hospital - an independent hospital which can provide acute medical, surgical or psychiatric care. It must be registered under The Registered Homes Act (1984) and approved by the Healthcare Commission or any future law. It may also include a private bed in an NHS hospital.

Inpatient

Medically necessary

-

In accordance with professional standards of medical practice in the United Kingdom

-

Clinically appropriate, in terms of type, frequency, extent, site and duration of treatment

-

Required for reasons other than the comfort or convenience of the patient or specialist.

-

Provided at an appropriate facility, in an appropriate setting and at an appropriate level of care for the treatment of the patient’s medical condition.

-

Provided only for an appropriate duration of time.

-

No more costly than an alternative treatment at least as likely to produce the same therapeutic or diagnostic results.

<

Members

Mental health condition

Outpatient

Plan

Year of cover

Daycase treatment

Outpatient treatment

Partner

Dental hygienist

Physiotherapist

Dentist

Specialist

- a medical practitioner with full current registration with the General Medical Council or

-

a dentist with full current registration with the General Dental Council

and

-

a specialist in the treatment you are referred for (this is applicable to all specialities including anaesthetics and psychiatry)

-

has a certificate of Higher Specialist Training in their specialty that is issued by the Higher Specialist Training Committee of the appropriate Royal College or Faculty

-

is or has been a National Health Service consultant or dentist

-

has been recognised for benefit purposes as a specialist by Healix.

<

The Plan

Therapist

-

a Chartered Physiotherapist

-

an Occupational Therapist registered with the British Association of Occupational Therapists

-

an Orthoptists registered with the British and Irish Orthoptic Society

-

a Speech and Language Therapist registered with the Royal College of Speech and Language Therapists

-

a dietician registered with the British Dietetic Association

<

Treatment

Treatments

Trust Deed

Trustee, Trustees

United Kingdom

We, Us, Our

You, Your

Member Zone

Member

Plan Year 2025

The new plan year renews on the 1st July 2025. There will be no changes made to the plan for this year.

Plan Year 2024

The new plan year will renew on 1st July 2024. There will be no changes to the plan for this year.

Plan Year 2023

The plan renews on 1st July 2023. There have been no changes to the plan for this plan year.

Plan Year 2022

The plan renews on 1st July 2022. There have been no changes to the plan for this plan year.

Plan Year 2021

The policy renews on 1st January 2021. The plan is renewing for an 18 month period and the benefits have been amended to reflect this.

Plan Year 2020

The policy renews on 1st January 2020. There have been no changes to the plan this plan year.

May 2018

The below changes have come into affect from May 2018.

| Amendment | |

| Data Protection |

The Data Protection page has been updated in line with the new General Data Protection Regulation (GDPR) legislation that came into effect on 25th May 2018. The Data Protection page has been changed to Healix Privacy Notice. |

Section 9: Glossary

The words and phrases below have the following meanings. They will appear in bold in this guide.

Annual renewal date

Benefit

Benefits

Complementary practitioner

- Acupuncture practitioners must be registered with the BMAS (British Medical Acupuncture Society), BacC (British Acupuncture Council), AACP (Acupuncture Association of Chartered Physiotherapists) or AAC (The Association of Acupuncture Clinicians)

- Osteopaths must be registered with the GOsC (General Osteopathic Council)

- Chiropractors must be registered with the GCC (General Chiropractic Council) <

Daycase

Dependant

-a member’s unmarried dependent children

Dependants

-a member’s unmarried dependent children

Emergency

Employer

General Practitioner

GP

High risk activities

Hospital

Private hospital - an independent hospital which can provide acute medical, surgical or psychiatric care. It must be registered under The Registered Homes Act (1984) and approved by the Healthcare Commission or any future law. It may also include a private bed in an NHS hospital.

Inpatient

Medically necessary

-

In accordance with professional standards of medical practice in the United Kingdom

-

Clinically appropriate, in terms of type, frequency, extent, site and duration of treatment

-

Required for reasons other than the comfort or convenience of the patient or specialist.

-

Provided at an appropriate facility, in an appropriate setting and at an appropriate level of care for the treatment of the patient’s medical condition.

-

Provided only for an appropriate duration of time.

-

No more costly than an alternative treatment at least as likely to produce the same therapeutic or diagnostic results.

<

Members

Mental health condition

Outpatient

Plan

Year of cover

Daycase treatment

Outpatient treatment

Partner

Dental hygienist

Physiotherapist

Dentist

Specialist

- a medical practitioner with full current registration with the General Medical Council or

-

a dentist with full current registration with the General Dental Council

and

-

a specialist in the treatment you are referred for (this is applicable to all specialities including anaesthetics and psychiatry)

-

has a certificate of Higher Specialist Training in their specialty that is issued by the Higher Specialist Training Committee of the appropriate Royal College or Faculty

-

is or has been a National Health Service consultant or dentist

-

has been recognised for benefit purposes as a specialist by Healix.

<

The Plan

Therapist

-

a Chartered Physiotherapist

-

an Occupational Therapist registered with the British Association of Occupational Therapists

-

an Orthoptists registered with the British and Irish Orthoptic Society

-

a Speech and Language Therapist registered with the Royal College of Speech and Language Therapists

-

a dietician registered with the British Dietetic Association

<